CROSBY MORTGAGE SOLUTIONS

A Friendly Face in the World of Finance ;-

© 2023 Crosby Mortgage Solutions Limited

Registered in England and Wales

Registered office address -

Trading address -

Registration number -

0151 924 9312

Crosby Mortgage Solutions does not charge for an initial consultation meeting.

A typical broker fee of £495 will be charged on application.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Crosby Mortgage Solutions Ltd is an appointed representative of PRIMIS Mortgage Network (PRIMIS) -

Most Buy-

The guidance and/or information contained within the website is subject to UK regulatory regime and is therefore targeted at consumers based in the UK.

First Time Buyers

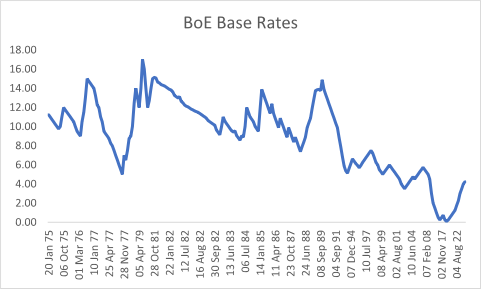

Although interest rates increased significantly in the latter part of 2022, they are still at levels that would be considered low prior to the banking crisis of the late 2008.

Mortgage affordability is, therefore, often not a problem for first time buyers, but many still find it difficult to save enough money required for a deposit and the up front costs of purchasing a property.

The increases in property prices of recent years has added to the issue of affordability, but many lenders have recognised the needs of the first time buyer who is unable to bring equity from previously owned property to the party.

There are range of options available today for first time buyers and we would be delighted to advise on the most appropriate solution for your circumstances.

Gifting from family members and, in some cases, even inter familial loans are an increasingly common occurrence.

When working with first time buyers we provide them with a budget spreadsheet that doesn’t simply cover the monthly costs of the mortgage, but all the other costs of buying your first home -